Since February, inventory has been down 60% year over year from 2020. The high buyer demand coupled with the low amount of inventory has caused home sales to soar across the Midwest. Usually, these swings are isolated to coastal markets and your mountain towns, or cities like Austin, TX or San Francisco, CA. Although there have always been more expensive places to live in the United States, the silver lining was there was always some other place that was more affordable because it was 2 hours outside of New York City or the Bay area. You could always sacrifice the convenience of being close to work for more “value” further away from the more expensive areas. That’s been one of the great foundational beliefs of America. You can find a “deal” in a more affordable area, somewhere in the United States. It’s been sewn into the fabric of our housing market mythology.

Now, that idea is collapsing with the market conditions but much differently than when the housing market has dipped in the past. Jim Dalrymple II of Inman News states that “Thanks to a unique convergence of an underproduction of homes, demographic shifts and the coronavirus pandemic, home price explosion isn’t just limited to the coasts any more. Instead, there are bidding wars across Minnesota and Connecticut and Florida and pretty much everywhere in between.” With more and more people working remotely, the need to be in a particular city is dwindling, and more and more people are flocking to the Midwest in the hopes of finding a better deal on property.

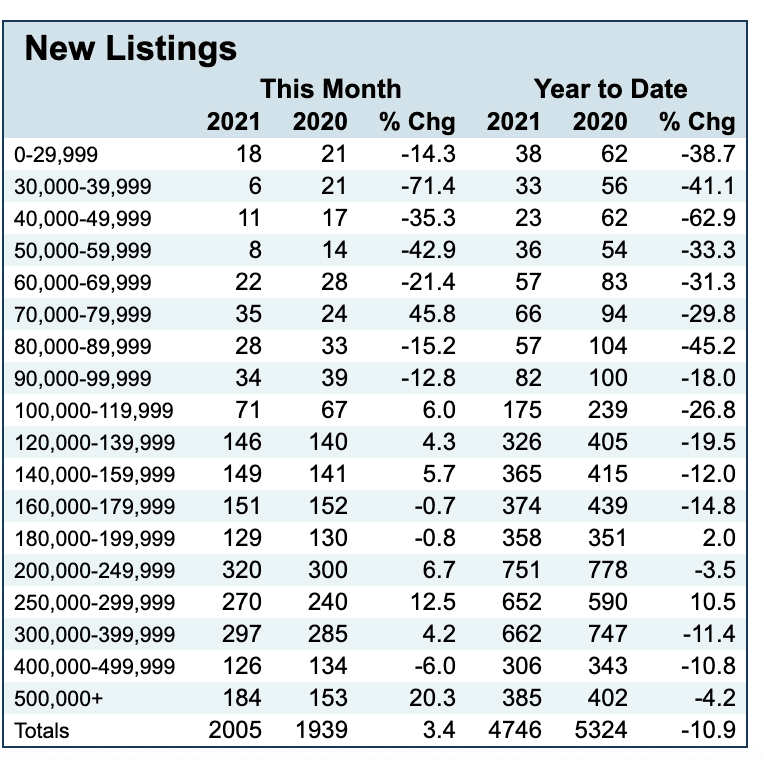

Louisville Kentucky Market Summary - New Listings

This data is supplied by the Greater Louisville MLS

What is happening now in the housing market was certainly exacerbated by the Pandemic, but inventory has been low for the past several years now. With the Fed keeping interest rates low, millennial buyers have flooded the market. Inventory is picking up but I don't think home prices will come back down until rates get closer to 5%, and that’s because there are more buyers in the market than there have been in years past where similar market conditions have been present (i.e., low inventory). Given the current pace, interest rates will remain relatively low (i.e., under 5%) until well into 2022, and maybe longer. Some economists believe that Washington has condemned Bear markets and will continue to keep rates low. There is a lot of wealth in the housing market right now and because money is relatively cheap, low 3% for the 30-year fixed, consumers are realizing that offering more money on a property now is better than waiting and risking rates soaring back high, as some experts suggest, given the volatility in the market since Covid.

Anecdotally: This past weekend, I sold one of my listings with 19 offers. and had two offers rejected for two separate buyers on properties that received 15 and 12 offers respectively. Needless to say, these market conditions have been very strong for sellers the past couple of months. But that doesn’t mean buyers can’t actually come out ahead.

Why Now Is Still The Time To Buy

We all know this is a crazy time in the market and some buyers are either getting frustrated because their offers are not being accepted or some are just plain scared to even start looking as it can be intimidating. Even though the market is geared towards the sellers right now, it’s still a great time to purchase a new home. With mortgage rates still near historic lows, it 100% still makes sense to purchase now and not wait until this fall or this time next year. I have talked a few buyers off the ledge this year once I ran some figures for them like I did below as they never imagined offering more than $10,000 above asking price.

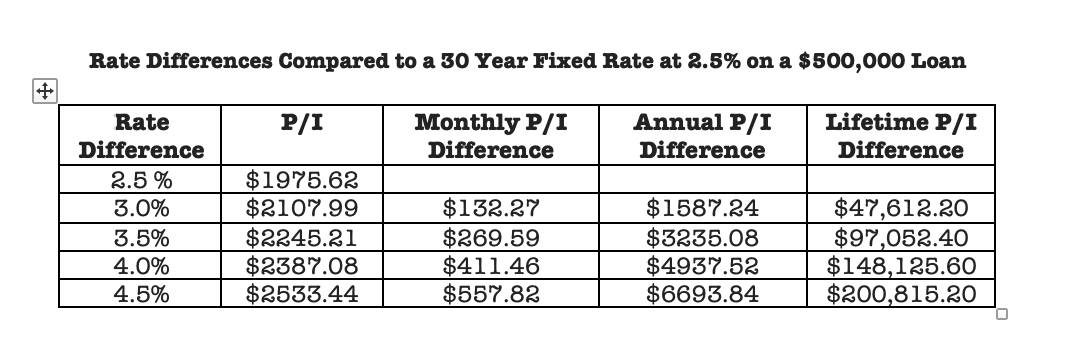

To give you an idea, rates earlier this year on a 30-year fixed were at the lowest, 2.375%. Let’s use 2.5% just to keep it at half point intervals. On a $500,000 loan, the principal and interest (P/I) would be $1975.62 at 2.5%. Today’s pricing at 3% would make the P/I $2107.99. This makes a monthly difference of $132.27 and an annual difference of $1587.24. Multiply this figure by 30yrs and that half point difference is now $47,612.20 more for the buyer.

No one knows what the rates are going to do going forward, but more than likely they will continue to slowly creep up. Below is a chart of half point increases up to 4.5% (which we were at only 2-3 years ago) compared to the 30yr fixed rate at 2.5%. Having to pay upwards of $35,000 over ask doesn’t look so bad now if you compare what rates could get back to in the very near future.

Building A Competitive Offer

With these numbers in mind, you may be wondering how to build a competitive offer in this current market. Here are a few things I have seen (and encouraged my buyers to do) to win the bidding wars.

Buyers are now starting to offer to pay closing costs for the sellers. Typically, the seller’s fees are not expensive, but you can offer to cover commissions, or portions of commissions, which can be enticing to sellers facing paying both the buyer’s and seller’s commissions.

Buyers that have a large sum of money to put down (20% or more) are offering to cover the difference of the appraisal and purchase price by a certain amount if it were to come in low. In some instances, they are offering over the appraised value. With purchase prices soaring above and beyond the asking price, the chance of a home not appraising is much higher. Offering to bring a certain amount of cash to the table to cover the difference helps to ease the seller’s minds.

Light Inspections- Many buyers are offering to pay for an inspection, but are agreeing NOT to request any repairs from the sellers. Doing so allows the buyers to see the current condition of the home (and reserve the right to terminate if red flags are discovered). Sellers like these offers because it ensures less out of pocket expenses (and headache) in trying to make repairs prior to closing.

Bridge loans—Sellers, in general, shy away from offers that are contingent on selling the buyer’s property first. There are so many variables that can cause the transaction to fall apart. Bridge loans allow buyers to use the equity of their current home together with the equity in their new home to purchase the property without having to close on their current home. Sellers are not scared of these any more. It actually makes them feel more confident if they know the bank is allowing them to own two homes at the same time. But the best option is cash, second will be a conventional loan. Any other deviation from a conventional loan could be used against the buyer depending on what other offers the Sellers have.